Financing Asia's Green Transition

Sustainable finance has gained significant momentum over the years, witnessing sharp growth in investments to promote the development of green strategies and support the transition to a more sustainable future. In a 2019 report, the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) estimated that the Asia-Pacific region alone requires an annual investment of US$1.5 trillion to achieve the UN SDGs by 2030, with clean energy and climate-resilient infrastructure accounting for almost a third of this figure ($434 billion).

Themed “Financing Asia’s Green Transition”, discussions at the Singapore Sustainable Investing and Financing Conference (SSIFC) 2022 will focus on how capital can be mobilised to accelerate investment in climate mitigation, catalyse climate innovations, develop stronger carbon markets and accelerate the energy transition.

Leveraging the combined networks and expertise of BlackRock, International Finance Corporation (IFC) and Temasek, SSIFC will convene key decision-makers from central banks, SWFs, financial institutions, private banks, government agencies and corporations across the Asia-Pacific region.

The second edition of Singapore Sustainable Investing & Financing Conference (SSIFC) will be held on 9 June 2022, as part of Ecosperity Week.

Programme

Marina Bay Sands

Sands Expo & Convention Centre, Level 5

Chairman & CEO, BlackRock

Minister in the Prime Minister’s Office, Second Minister for Finance and National Development, Republic of Singapore

As countries and corporates accelerate towards net zero, there needs to be a fundamental shift in the deployment of capital to catalyse systematic change. There has been a remarkable uptick in interest to mobilise private capital into the new green economy, with significant commitment by major funds toward green financing. The Glasgow Financial Alliance for Net Zeo (GFANZ) – a global coalition of more than 450 financial firms, from 45 countries – leverages US$130 trillion in private capital and is widely recognised as a critical vehicle in the race towards net zero. Yet there remains a significant shortfall in capital flows – annual investments in sustainable solutions will need to increase to US$4 trillion by 2030 in order to limit global warming to 1.5°C.

How has private finance been aligning behind climate action? How will it be allocated to scale investments and achieve transformative alignment?

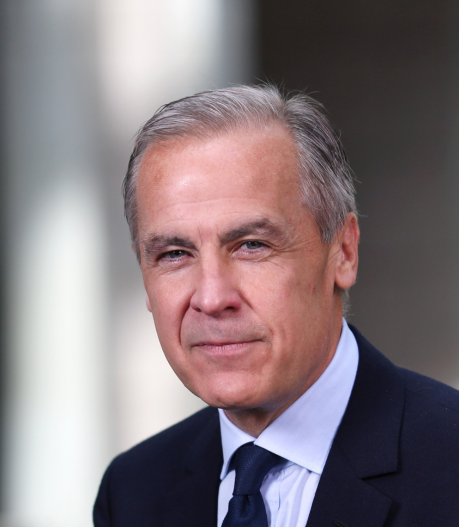

Co-Chair, Glasgow Financial Alliance for Net Zero, UN Special Envoy for Climate Action and Finance

Chief Financial Officer, Temasek

Asia accounts for more than half of global energy consumption. 85% of Asia’s energy consumption comes from fossil fuels, with energy demand expected to at least double by 2030. We have nearly universal government commitments to reach net zero, but they are not yet enough to deliver net zero by 2050. The success of the global net zero transition will largely be determined by Asia’s net zero path.

How can Asia simultaneously decarbonise and energise while maintaining reliable and affordable energy for its economic development? Trillions of dollars are required to finance the net-zero transition in the region but how do we source and ensure financially viable projects to attract the needed capital?

The urgency of the net-zero transition demands governments, businesses and investors to formulate a new energy paradigm in Asia while also maintaining resilient and secure energy systems. In this panel, we will discuss how companies and investors can navigate, drive and invent Asia’s energy transition.

Global Head of Sustainable Investing, BlackRock

Global Head, Decarbonization Partners

Vice President, Sustainability and Climate Change, BHP

Green Finance Resource Lead, Monetary Authority of Singapore

The world must reach net-zero carbon emissions by mid-century to stave off the worst effects of climate change. Cutting financed emissions, mobilising private finance, accelerating innovative solutions and voluntary carbon trading are some of the tools that can help us get there.

In this session, Bill Winters, Group Chief Executive of Standard Chartered Bank and also Board Member of Climate Impact X, will share about the important role that banks and carbon markets play in the transition to net zero, with a focus on Asia.

Group Chief Executive, Standard Chartered PLC

Driven by net-zero pledges from countries and corporations and consumer demand for stronger ESG commitments, the demand for carbon credits is projected to increase by a factor of more than 100 times by 2050 and potentially create a market valued at more than US$550 billion. Yet uncertainty remains over regulatory policy and the supply of credits to sustainably grow the carbon market. As the outlook on carbon markets faces increasing complexity, how can we ensure the integrity of carbon markets and the supply of high quality credits?

Meanwhile, the demand for Nature-Based Solutions (NBS) continues to grow. With Asia predicted to be a major contributor of NBS credits, are capital flows sufficiently aligned behind ambition? How can we accelerate innovation and transition to deliver a high integrity and inclusive carbon market?

This session features a panel discussion on key levers to scale up carbon markets, followed by a dialogue on how companies can simultaneously deliver innovation and investment in low carbon solutions.

CEO, Verra

CEO, South Pole

Managing Director, Impact and Advocacy, New Forests

CEO, Climate Impact X

CEO, GenZero

Founder, Dragonfly Advisory

Sustainable finance volumes surged past US$1.7 trillion in 2021, as the market responded to investor appetite for financial instruments with environmental, social, and governance goals. Growth was driven in large part by sustainability-linked loans and bonds, which quadrupled from 2020 to 2021 to reach $530 billion by year-end. Two-thirds of these issuances included metrics assessing impacts on the environment - but what about impacts on people? Ultimately, social and environmental factors are inextricably linked and this session will explore an integrated approach to sustainable finance.

How can we incorporate the human dimension into our strategies to generate positive social impacts while simultaneously achieving economic and climate objectives? What are the most urgent social and socio-ecological challenges? Can we be more robust and ambitious in defining Sustainability Performance Targets?

Partner and Sustainability & Climate Change Leader, PwC Singapore

Regional Vice President, Asia and Pacific, International Finance Corporation

Managing Executive Officer & Co-Head of the Asia Pacific Division, Sumitomo Mitsui Banking Corporation

Head, ESG Investment Management & Managing Director, Sustainability, Temasek

Minister of Environment and Forestry, Republic of Indonesia

Vice Chairman, Sustainability, Temasek

Partner Events

Timings indicated are Singapore time (GMT+8)

The IFC-SMBC-Sembcorp-PwC Roundtable is an invitation-only event.

The International Finance Corporation (IFC), Sumitomo Mitsui Banking Corporation (SMBC), Sembcorp Industries and PwC Singapore are convening a roundtable on the actions needed of all key stakeholders to enable a coordinated energy transition to bring about structural and impactful change across Asia Pacific in 2022 and beyond. The discussion aims to distill issues of vital importance to the region as countries work to transition away from fossil fuels to renewable sources of energy.

For years, it was believed that if businesses committed to measuring and reporting their sustainability performance, their performance would improve because what gets measured gets managed. But if what is measured is incomplete and imprecise, companies could have tougher challenges than anticipated on their sustainability journey.

Terrascope CEO Maya Hari will be hosting leaders from business, policy and sustainability to exchange ideas on how to catalyse decarbonisation efforts in the areas that truly matter, solving for Scope 3 measurement and improving overall speed and accuracy of the process.

Businesses are increasingly recognising that nature-based solutions have a role to play in carbon-offsetting as part of their holistic abatement strategy to achieving net-zero targets. While there are a number of such carbon projects in the market that businesses can invest in, few are able to demonstrate that the carbon credits generated are credible, legitimate and meaningful.

RGE will host a fireside chat with Professor Koh Lian Pin of the NUS Centre for Nature-based Climate Solutions, and Lucita Jasmin, Director of Sustainability & External Affairs of the APRIL Group, to discuss what makes good quality carbon credits and how one can access them.

Details of the event can be found here.

Started in 2018, The Liveability Challenge is a global call for viable, groundbreaking solutions to some of the greatest problems facing cities in the tropics in the 21st century. Finalists stand the chance to secure up to S$1 million to fund their game-changing solutions.

The Liveability Challenge is presented by Temasek Foundation and organised by Eco-Business.

Visit the event website for details.

The voluntary carbon market (VCM) is projected to see exponential growth in the lead up to 2050 and beyond. When done right, the benefits of carbon credits can go beyond carbon sequestration to cover broader environmental, social and economic impacts for communities.

Climate Impact X, a Singapore-based global carbon marketplace and exchange, is bringing together experts, business leaders and policymakers for an invitation-only panel and networking session to discuss the latest developments, challenges and opportunities in the fast-evolving VCM. The event aims to serve as a platform for the exchange of ideas on new and emerging technologies and solutions that can help businesses transition effectively, and use carbon credits to deliver genuine climate impact.

View the rest of the programme for Ecosperity Week 2022 here.

Speakers & Moderators

Republic of Singapore

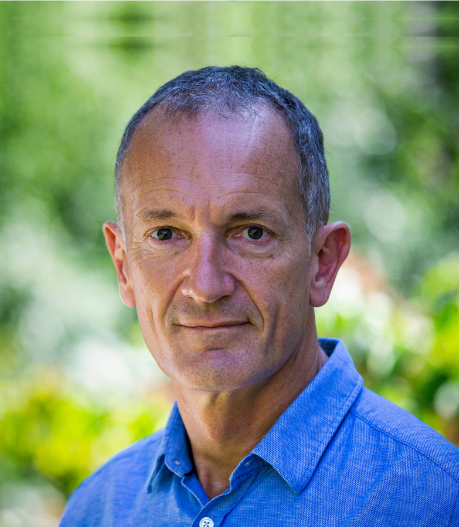

UN Special Envoy for Climate Action and Finance

SSIFC 2021

The inaugural Singapore Sustainable Investing & Financing Conference (SSIFC) on 30 September 2021 brought together key actors from the Asia-Pacific region, including senior level representatives from central banks, SWFs, financial institutions, private banks, government agencies and corporations.

Themed “Bridging the Gap – Advancing Asia’s Sustainable Future”, the conference focused on drivers needed to catalyse sustainable investing and financing.

{{ item.title }}

BlackRock disclaimer

This is issued by BlackRock and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, BlackRock funds or any investment strategy nor shall any securities be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Risk is inherent in all investing. © 2022 BlackRock, Inc. All Rights Reserved. BLACKROCK is a registered trademark of BlackRock, Inc. All other trademarks are those of their respective owners. MKTGH0322A/S-2078132