Economic Disruption, Protectionism and Energy Shortages will Put Climate Policies to the Test

Industry leaders warn that addressing climate change will bring with it political instability, rising protectionist policies and inflation in poorer nations, placing pressure on the resolve of governments to see the energy transition through.

Climate policies will be put to the test as the rush to roll out renewables and slash carbon emissions contribute to energy price spikes and shortages. Transition risks associated with tougher climate policies could increase political instability, compounding insecurity that is already being caused by climate change.

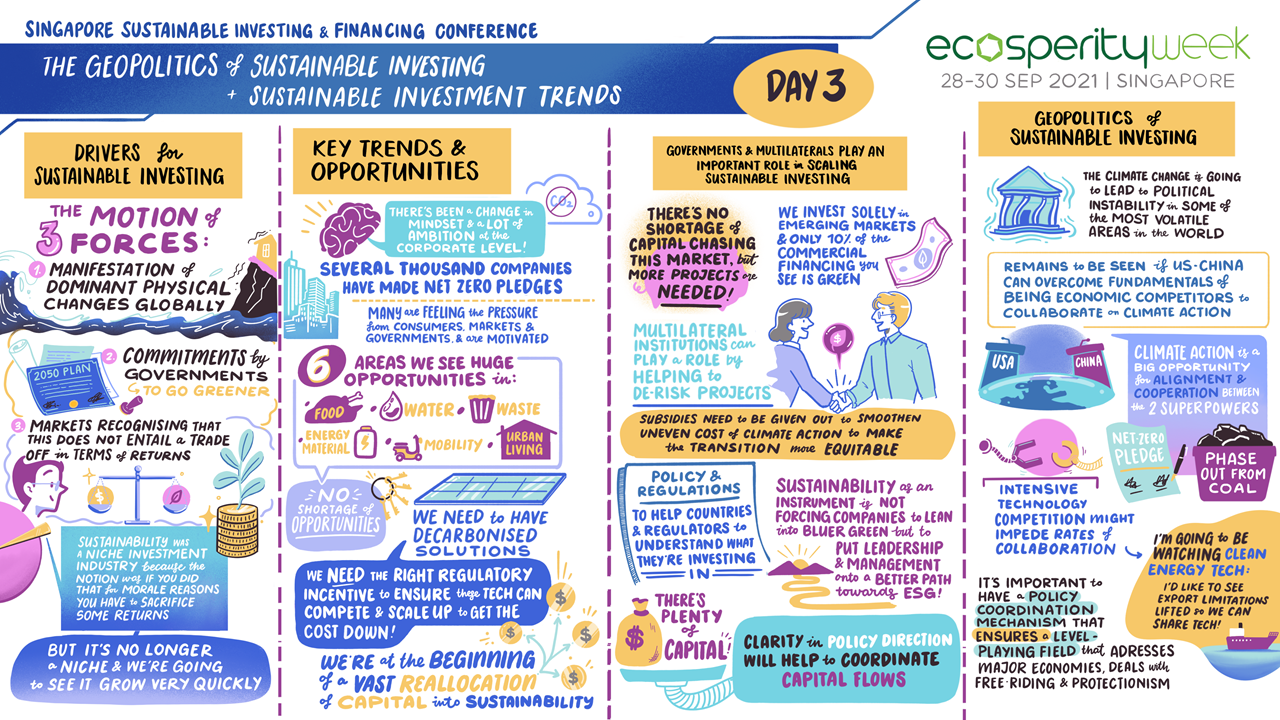

Panellists during the inaugural SSIFC event urged for a clear path to reducing emissions, and incentives to ensure that technology and clean energy can scale in tandem with a decline in fossil fuel energy.

Greater co-ordination between multilaterals to set a standard global carbon tax regime could help guard against a fragmented carbon market that some countries may use to veil protectionist policies.

Executives from BlackRock, the IFC and Temasek speaking at a panel moderated by Bloomberg's Haslinda Amin, at the inaugural Singapore Sustainable Investing and Financing Conference

Executives from BlackRock, the IFC and Temasek speaking at a panel moderated by Bloomberg's Haslinda Amin, at the inaugural Singapore Sustainable Investing and Financing Conference

Emerging economies are likely to feel the sharper end of climate policies, including carbon border adjustment taxes, given they lag in the transition away from fossil fuels, said experts from BlackRock, Temasek and the International Finance Corporation (IFC). Greater intervention is needed to ensure that difficulties arising during the energy transition do not derail climate policies.

"Greening the world is going to be a very expensive task over the next few years. It is going to be highly inflationary, particularly in emerging markets," said Rohit Sipahimalani, chief investment strategist at Temasek. "There is a high risk that governments will not have the stomach to see it through."

An acute energy squeeze has engulfed China and India, signalling how volatile Asia's energy transition is likely to be in the next few decades. Electricity shortages due to scant coal supplies and patchy renewable energy to plug gaps, could create a backlash against climate policies, warned several panellists at the inaugural Singapore Sustainable Investing & Financing Conference (SSIFC), an event co-organised by investment manager Blackrock, IFC and state investment firm Temasek as part of Ecosperity Week 2021, hosted by Temasek.

Funnelling cash flow towards green technology and capacity-building in emerging markets will be a focal point at this year's climate conference, COP26, in Glasgow. Regulatory incentives are needed to ensure that technologies can compete and scale up in tandem with the decline in fossil fuel energy. "Because if that doesn't happen, and you have huge disappointments, I think it'll be a huge setback for us," Sipahimalani said.

Specific government policy and clarity on how net-zero commitments will be reached will be crucial to unlocking capital flow. "No fiscal policy from the public sector will be enough to cover the trillions of dollars that will be required for many, many years to come to get us to net-zero," said Philipp Hildebrand, vice chairman of BlackRock.

"We are going to see wholesale change throughout the global economy. If we don't [change our financial system], we are going to get the manifestation of physical risk [from climate change] and it will become ever more painful."

A combination of protectionist policies, petroleum states holding gas to ransom and trade tensions could contribute to insecurity that is already being created by a changing climate, warned several experts speaking at the SSIFC. "You're going to see massive, forced migration [and] a lot of national security issues," Henry M. Paulson Jr., founder and chairman of the Paulson Institute said.

"Economic disruption [will be] on par with what we have seen with Covid. Our political system isn't set-up to really respond well to climate risk," Paulson said. "We need more incentives to bring money into some of these more difficult and important technologies."

The rise of protectionism

Some mechanisms, including border carbon adjustment measures that are designed to hammer carbon emissions down, could disproportionately hit emerging and developing nations that are not core polluters.

More than 60 different carbon pricing schemes function globally, covering about 22 per cent of total emissions, according to the World Bank. Carbon prices vary widely from under a dollar in Poland to US$137 in Sweden, according to the bank.

Border carbon adjustment measures are intended to ensure that foreign competitors are subject to the same carbon costs as domestic producers. Safeguards are needed to prevent protectionist-driven carbon border taxes amid fears that they could be punitive for emerging and developing nations and could be used as a front for protectionist trade policies.

"I'm actually quite worried about some of the border taxes that are beginning to be developed, especially in Europe," said Stephanie von Friedeburg, senior vice president of operations at the IFC.

The European Union is proposing a Carbon Border Adjustment Mechanism (CBAM) which is intended to mitigate the competitive disadvantage of European industries that have to comply with the EU's green policies, by taxing the carbon content of imports into the regional bloc, making them equivalent to goods produced in the EU in terms of carbon pricing.

Von Friedeburg said that the creation of some border taxes is symptomatic of moves towards greater protectionism. "If you look at the requirements that the Europeans are putting in place, as an example, Africa won't be able to trade with Europe."

Inconsistency and fragmentation within carbon pricing systems risk exacerbating trade frictions and could reduce the effectiveness of green investment, wrote Ngozi Okonjo-Iweala, director-general of the World Trade Organisation. "Worse, it could weaken the effectiveness of global efforts to mitigate climate change."

India and other developing nations have vocally opposed plans by the EU to penalise imports of carbon-intensive goods to curb emissions, particularly as rich countries have dragged their feet over the provision of promised financial aid to help with the energy transition. In June, India's environment minister Prakesh Javadekar described the tax proposal as "regressive" which had "no principle of equity adhered to."

The International Monetary Fund has also criticised the CBAM, believing that it is too distortive a mechanism compared to other options, such as a carbon price floor.

The Organisation for Economic Co-operation and Development (OECD), a collective of the world’s leading economies, should help to set a standard global taxation regime, said BlackRock's Hildebrand. Greater co-ordination between multilaterals could "prevent these border adjustment taxes being used as a front for purely protectionist purposes," he said at the event.

Global emissions trading could reduce the total mitigation cost of meeting current Paris agreement pledges by 59 to 79 per cent, according to the Environment Defense Fund, a think-tank. However, the practicalities of implementing a global carbon policy fairly are likely to be politically fraught and technically difficult.

"I think we have to be realistic - there are going to be border adjustment taxes in a world where not everyone is going to have carbon taxes... so we need to find ways to set standards," Hildebrand said.

Watch the sessions on-demand below: