Climate-related risks are a growing threat to global economies, with many Asian countries more vulnerable to the physical impacts of climate change and bearing greater transition burden given their carbon-intensive economies. The Pricing Climate Risks in Asia report explains why it matters to businesses and financial institutions (FIs), developments in methodologies for climate risk analysis, and how businesses and FIs are managing climate risks today.

Pricing Climate Risks in Asia: How to mitigate risk and seize opportunities

Asia is particularly vulnerable to the impacts of climate change. If no action on climate change is taken, Asia’s GDP may shrink 26.5% by 2048, compared to a 18.1% reduction of the global economy under the same scenario.

Asia is particularly vulnerable to the impacts of climate change. If no action on climate change is taken, Asia’s GDP may shrink 26.5% by 2048, compared to a 18.1% reduction of the global economy under the same scenario.

As countries around the world seek to recover from the Covid-19 pandemic, there is significant risk that the fight against climate change may be deprioritised in the wake of the global pandemic. However, environmental degradation, increasing greenhouse gas (GHG) emissions and rising temperatures must be addressed urgently in the face of more extreme weather and ecological catastrophes.

Climate-related risks - both physical and transition risks - matter more than ever. They can disrupt businesses and economies, and require significant investment and adaptation by companies, households, and governments to mitigate.

Asian countries are disproportionately affected by climate change

A worsening climate drives more frequent extreme natural disasters (such as typhoon and floods), rising sea levels, and ecosystem degradation, leading to enormous economic losses. Asian countries are found to be much more vulnerable to natural disasters induced by climate change. The Global Climate Risk Index (CRI) showed that 6 out of 10 of most climate-vulnerable countries are in South and Southeast Asia. According to the Climate Economics Index (CEI) developed by the Swiss Re Institute, Asia’s GDP may shrink 26.5% by 2048 if no action on climate change is taken, compared to a 18.1% reduction of the global economy under the same scenario.

Many Asian countries also bear greater transition risk given their carbon-intensive economies. Due to their high reliance on carbon-intensive resources, such as fossil fuel and steel, adopting carbon-neutral targets and measures to mitigate carbon emissions will heavily affect the economy, businesses, and financial activities in these countries.

Businesses and financial institutions (FIs) may face climate-related risks

Climate change can disrupt business operations and cause economic losses to customers and markets. A corporation’s resilience to climate change depends on its business plan, risk management ability, and governance.

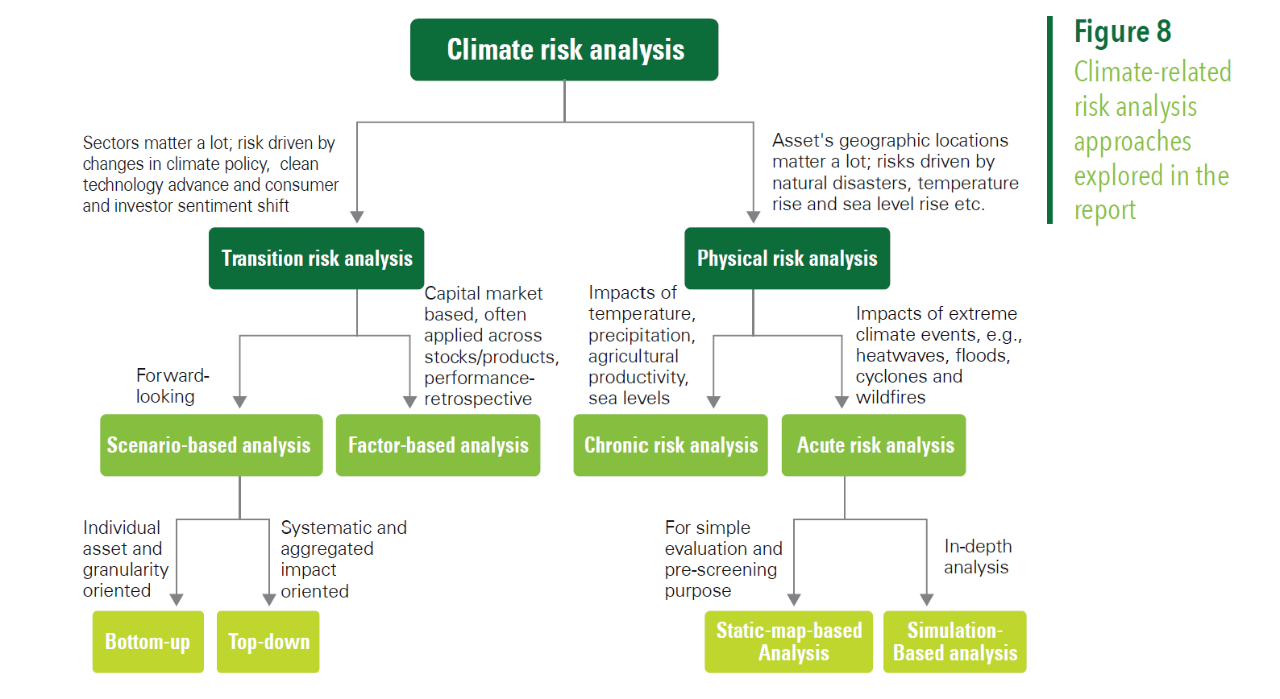

Both climate change and the responding mitigation efforts can lead to business and financial risks that can be further categorised into physical and transition risks:

Physical risks – acute and chronic impact from extreme weather events due to climate change

Transition risks – financial and reputational risks resulting from policy, legal, technology and market changes in the transition to a low-carbon economy

On the bright side, proactive climate risk management can help organisations mitigate risk and seize opportunities

Incorporating climate risks analysis into business decision-making will better position businesses and financial institutions in Asia to mitigate risks and seize opportunities. Conducting climate risks analysis will gradually become required for internal risk management and regulatory compliance. It is also increasingly expected by investors and clients. Tools and methodologies have been developed to model the range of climate-related risks across sectors, regions, and time horizons. The most common approach is the scenario analysis, a type of stress test under alternative climate scenarios often based on temperature targets.

Businesses can also mitigate their climate risk through carbon accounting, ESG integration and participation in disclosure initiatives. FIs can incorporate climate-related factors in their strategies, governance, risk management, asset allocation, and disclosure reports. They can also engage and support existing carbon-intensive clients on transition opportunities.

Charting the way forward

Climate-related risk assessment is complex and still only in its infancy. Tools and methodologies are being constantly updated to allow for more detailed analysis that considers a wider set of scenarios and more granular datasets.

Today, many organisations in Asia are still not yet actively identifying and managing climate risks. This could be due to insufficient awareness and understanding of climate related risks, a lack of capability to conduct climate risk analyses or a data gap. While the current methods to quantify physical climate risks are also limited, the quality of the models and data will improve if investors demand for actionable decisions.

Governments and regulators also have a central role to play to create a conducive regulatory environment. Countries with a higher level of awareness of these risks should mobilise resources to advance research and improve the tools and methodologies for climate pricing. Regulations should also be designed in alignment with overall climate risk management goals.

A concerted effort among businesses, financial institutions, and governments will be required to build capability, collect robust data, and grow an actionable understanding of the true impact of climate change on businesses, in order to facilitate a just and tenable transition to a low-carbon economy.